Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any. Any meat bones hide skin hoofs horns offal or any part of the animals and Poultry.

Sugar Import In Malaysia Process Of Applying For This License Malaysia How To Apply Sugar Tax

The challenge for a business would be assessing the nature of the services it imports and determining whether they are.

. Last published date. More 59. Sales Tax Customs Ruling Regulations 2018 iv.

For certain goods such as alcohol wine poultry and pork Malaysia charges specific duties that represent considerably higher effective tariff rates. Budget 2019 Indirect Tax Updates On 2 November 2018 the Malaysia Minister of Finance tabled the 2019 National Budget. Goods exempted from Sales Tax include basic food eggs vegetables cereals pharmeceutical products and steel products.

Please complete information below. Want to save time. This page is also available in.

On the First 5000. Goods which are subject to 5 percent Sales Tax include certain food prepared fruits vegetables and meats printers and mobile phones. However with effect from 692017 the.

Egg in the shells. Imported Taxable Services. Sales Tax Regulations 2018 iii.

The related legislation for the implementation of sales tax is as follows. Live animals-primates including ape monkey lemur galago potto and others. Calculations RM Rate TaxRM 0 - 5000.

Import Duty and Sales Tax Exemption on KN95 Type Face Mask. Objective The objective of this Public Ruling PR is to explain -. Customs Anti-Dumping Duties Order 2019 Amendment 2022 Customs Anti-Dumping Duties No.

The Guide to Taxation and Investment in Malaysia 2019 is a bilingual English-Korean summary of investment and tax information prepared and developed by Deloitte Malaysia Korean Services Group. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya. A specific Sales Tax rate eg.

Get updates on the current investment climate and find out the latest on withholding taxes indirect taxes and more in this Guide. Assessment Year 2018-2019 Chargeable Income. Effective 1 January 2019 any person importing a taxable service into Malaysia for the purposes of business is required to file a return and pay the service tax in respect of the service imported.

TARIFF SCHEDULE OF MALAYSIA Tariff schedules and appendices are subject to legal review transposition and verification by the Parties. The importations of goods specified below are prohibited except under an import licence or permit from relevant authorities. The Goods and Service Tax GST has been repealed and the old Sales and Service Taxation SST with possible modification will commence in 2018.

It incorporates key proposals from the 2020 Malaysian Budget. Imported Taxable Service means any taxable service acquired by any person in Malaysia from any person who is outside Malaysia. Melayu Malay 简体中文 Chinese Simplified Guide to Imported Services for Service Tax Guide on Imported Taxable Services.

Afghanistan Albania Algeria American Samoa Andorra Angola Anguilla Antarctica Antigua and Barbuda Argentina Armenia Aruba Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bermuda Bhutan Bolivia. Malaysias tariffs are typically imposed on an ad valorem basis with a simple average applied tariff of 61 percent for industrial goods. Get updates on the current investment climate and find out the latest on withholding taxes indirect taxes and more in this Guide.

Service Tax Policy No 12019. The imposition of service tax on imported services will be carried out in two phases. Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia.

On the First 5000 Next 15000. More 96. Export tariffs and taxes.

On the First 5000. Sales Tax Act 2018 ii. The Guide to Taxation and Investment in Malaysia 2019 is a bilingual English-Chinese summary of investment and tax information prepared and developed by Deloitte Malaysia Chinese Services Group.

A new provision will be introduced in the Service Tax Act 2018 to enable the recipients of the imported services to account declare and pay the service tax to Malaysia Customs. 030 Malaysian ringgits MYR per litre is applicable. Under Malaysias Customs Act 1976 tariffs paid on exported goods which were originally sourced from imports are eligible for a 90 percent refund.

20192020 Malaysian Tax Booklet. With effect from 1st January 2019 service tax will be imposed on the imported taxation services into Malaysia Section 7 of Service tax Act 2018 amended under Finance Act 2018. General Guide On Sales Tax - Ver 4 As at 19 January 2019.

Imported Taxable Service means any Taxable Service acquired by any person in Malaysia from any person who is outside Malaysia defined under Section 2 of Service tax Act 2018. Sales Tax Determination of Sale Value of Taxable Goods Regulations. Malaysia Import Duty Calculator.

Income Tax Rates and Thresholds Annual Tax Rate. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practice. Malaysia is chargeable to tax in Malaysia regardless of whether the se rvices are performed in or outside Malaysia.

More 95 03092019 Sales Tax Service Tax Orders. Imposition of service tax on Imported Taxable Service Service tax shall be charged and levied on any imported taxable service at the rate of 6. Jalan Rakyat Kuala Lumpur Sentral PO.

With effective from 1 January 2019 imported taxable service is subjected to service taxIn accordance with Section 2 of Service Tax Act 2018 imported taxable service means any taxable service acquired by any person in. Box 10192 50706 Kuala Lumpur Malaysia Tel. Malaysia - Import Tariffs Malaysia.

Malaysias tariffs are typically imposed on a value-add basis with a simple average applied tariff of 61 percent for industrial goods. Customs Duties Goods under the MalaysiaJapan Economic Partnership Agreement Order 2006. The only authentic tariff commitments are those that are set out in the Tariff Elimination Annex that accompanies the final signed Agreement.

Up to 128 cash back Duties Taxes Calculator to Malaysia. 10 December 2019 Page 1 of 42 1. Who should account for service tax on Imported Taxable Service.

Malaysia Non-Residents Income Tax Tables in 2019. Free Industrial Zones and Free Commercial Zones. Services imported by business B2B to be implemented from 1 January 2019.

Exporting from which country. Estimate your tax and duties when shipping from Malaysia to Malaysia based on your shipment weight value and product type. Trying to get tariff data.

Effective from 1 January 2019 import duty rate is proposed to reduce from 25 to 15 on such bicycles. 102019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Malaysia customs apply a tariff on exported goods between 0 to 10 percent following ad valorem rates.

Duties Taxes Calculator to.

21 Sept 2020 Forced Labor Infographic Crude

Malaysia Imports From China 2022 Data 2023 Forecast 2015 2021 Historical

Share Of Solar Pv Imports United States By Source Country Statista

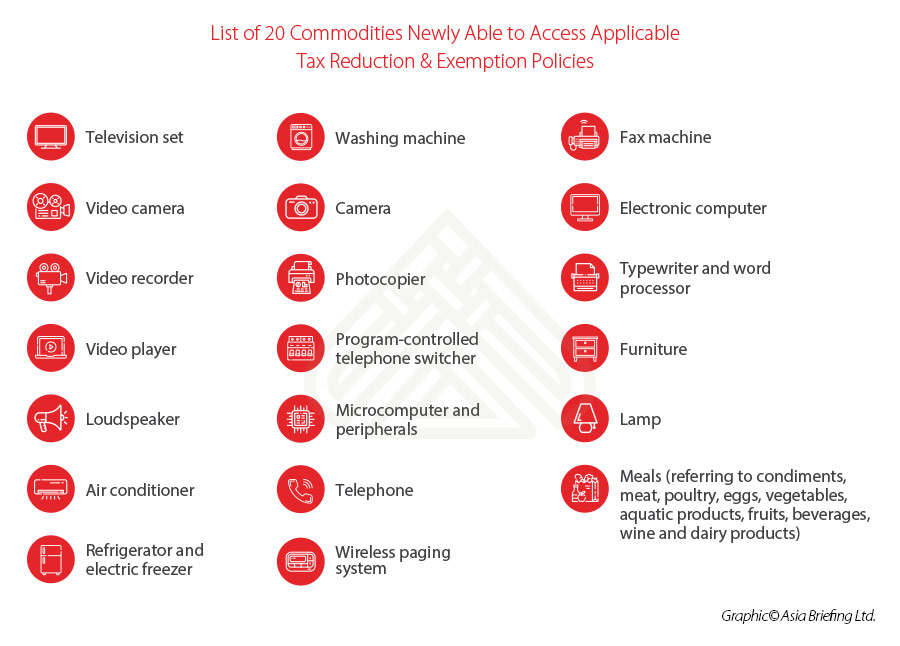

China Reinstates Import Tax Reduction And Exemption For 20 Commodities

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Shipping To Malaysia Services Costs And Customs

Looking To Purchase Vehicles Parts Online From Overseas Stores Watch Out For Import Duties Taxes Paultan Org

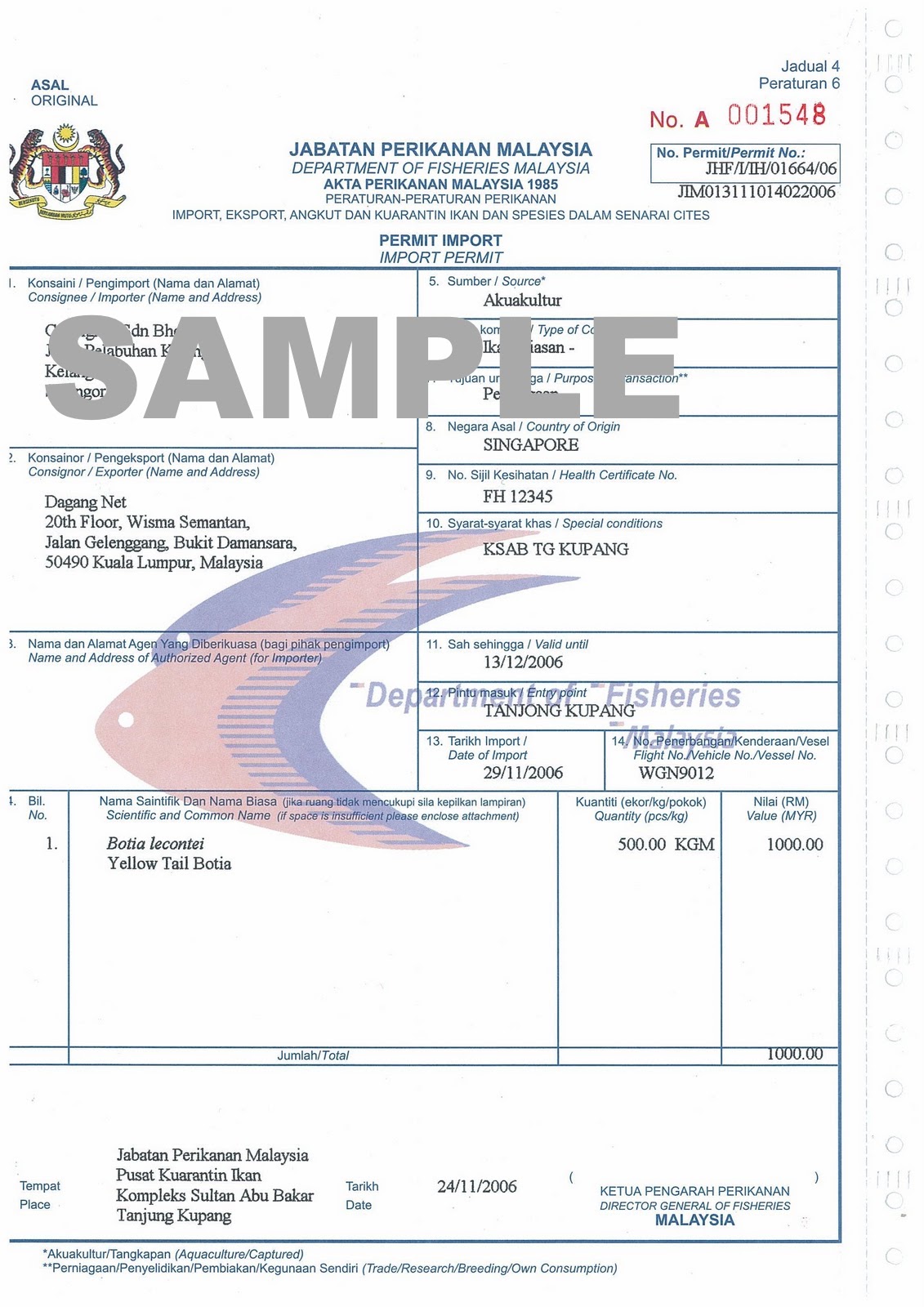

Import And Export Procedures In Malaysia Best Practices Ansarcomp M Sdn Bhd

How To Import To Malaysia Step By Step Process

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

United States Imports From Malaysia 2022 Data 2023 Forecast 1991 2021 Historical

Malaysia Import Of Goods 2020 Statista

Malaysia Market Profile Hktdc Research

Import And Export Procedures In Malaysia Best Practices Asean Business News

There Are Currently Five Bauxite Mines In Australia Providing Feedstock For The Seven Alumina Refineries Which In Turn Supply Alumina Bauxite Export Australia

Customs Clearance In Malaysia Duties Taxes Exemption

How To Avoid From Custom Duties In Malaysia Xtremepassion